Gas Tax Amendment Fuels Senate Debate

By now, you have undoubtedly noticed the rising price of gasoline here in the Commonwealth, and in fact, across the US. To help people with this unexpected cost, several states, including Georgia, Maryland and most recently Connecticut instituted a gas tax holiday period.

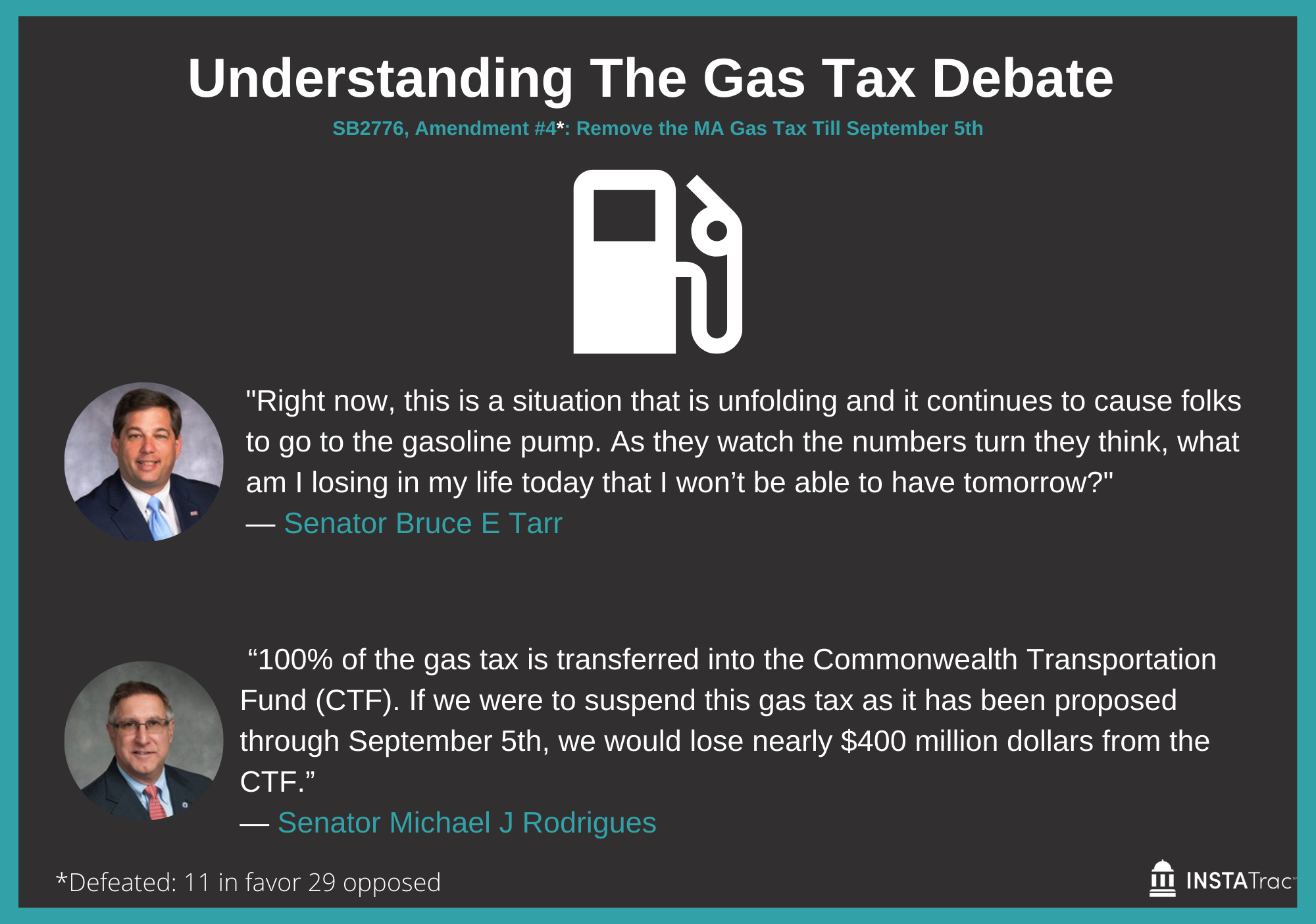

During the month of March, here in Massachusetts, the debate over creating a gas tax holiday took center stage. Legislators in both branches sought to make amendments to the 2022 supplemental fiscal appropriation bills (HB4532 and SB2776), which would have eliminated the Massachusetts $0.24 per gallon gas tax until September 5th of this year. In spite of the amendments not passing, discussions about suspending the gas tax fueled passionate debate, particularly in the Senate.

On March 24th, the Senate began debate on SB2776, but arguably no amendment divided the senators more than amendment #4 filed by Sen. Ryan Fattman, that proposed a gas tax hiatus. Fattman and fellow Republican members were unsurprisingly in favor of this effort, but they were not alone. Eight other senate democrats also voted in favor of the proposal. Interestingly, each of these senators hail from districts well outside of larger urban areas in Massachusetts, meaning many of their constituents likely have a car as their main mode of transportation.

Aside from the quotes shown above from Ways and Means Chair, Sen. Michael Rodrigues and Senate Minority Leader, Sen. Bruce Tarr, many other legislators joined in the lively debate. In giving his remarks of why he filed the amendment, Sen. Ryan Fattman pointed out that individuals from his district sometimes have to fill up their tank “3, 4, 5, even 6 times a week” so the $3.64 that could be saved per fill up would total “between $750 to $1200 per year in savings to one particular person or family”.

Republican counterpart Sen. Patrick O’Connor likewise described how the gas tax is an issue linked with equity, as he stated that “the majority of people who can't work from home and have to drive to work are lower income individuals”. In rebuttal, Sen. Brendan Crighton (D) doubled down on the majority opinion, arguing that without the revenue from the gas tax, “the backlog of transportation improvements and service upgrades needed in Massachusetts will only continue to grow”.

The divisiveness of this amendment led to widespread media coverage, charged more by interest group comments from the National Federation of Independent Business and the Massachusetts Fiscal Alliance. Even Governor Baker was prompted to speak on the topic, as one NBC Boston article describes his supportive stance of the gas tax holiday despite it being a lesser priority than other issues in the bill .

While the gas tax amendment failed and received significant news coverage, many other important bills in the legislature are not spotlighted by the media. For all the passionate debate that still occurs, Instatrac is there to provide it to our clients! Catch all the legislative wrangling with our transcripts and our additional coverage.

If you don’t currently have a MassTrac subscription, reach out for a free trial! Email info@instatrac.com for more information.