Breaking Down Governor Healey’s Budget Bill

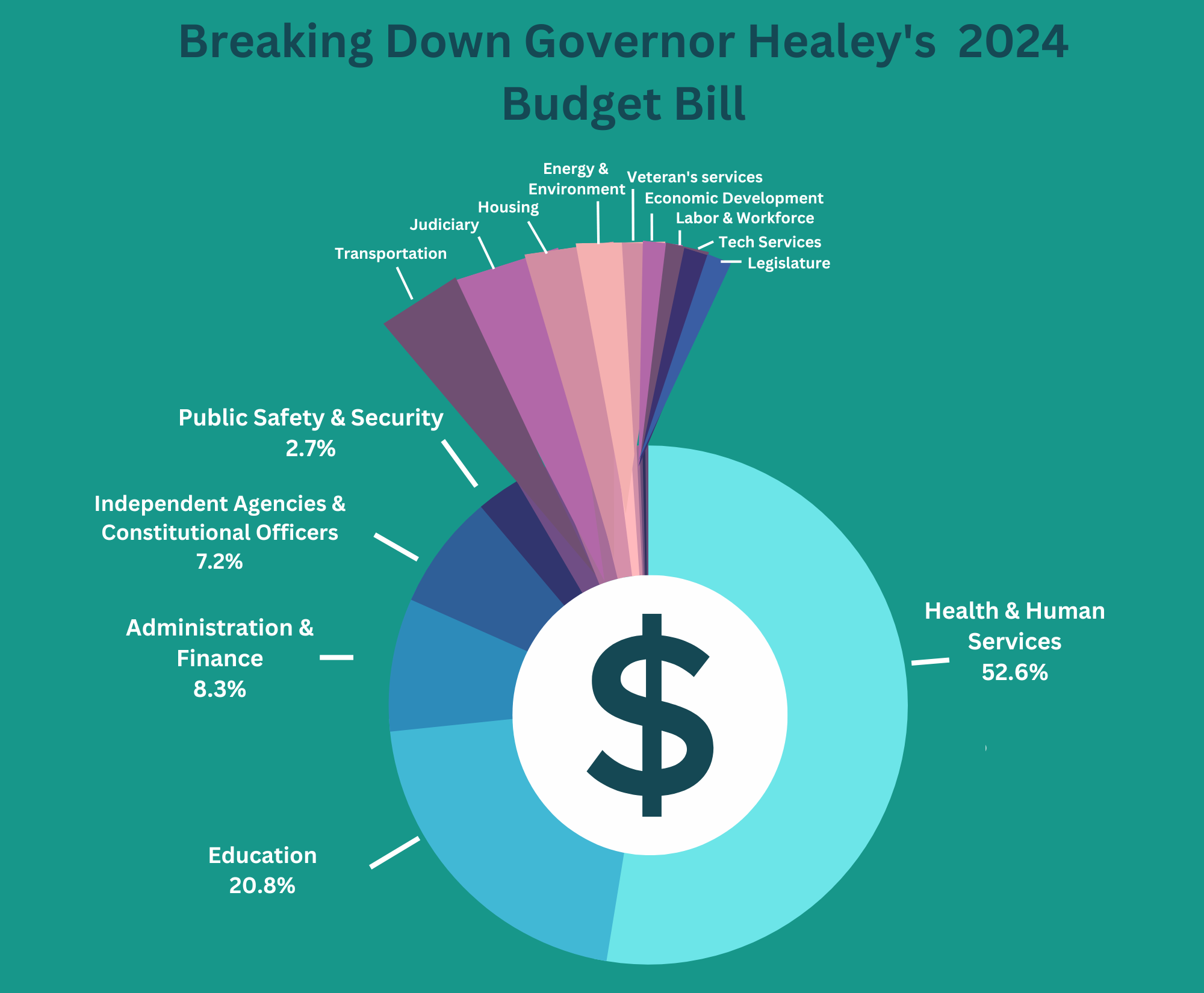

This Wednesday, March 1, Governor Healey unveiled her $55.5 billion state budget for the 2024 fiscal year. The budget is consistently the largest, and often most contentious, piece of legislation that is passed in the legislature every session. Establishing a budget takes months of planning and research in order to best address the needs of the Commonwealth in the most fiscally responsible way, for both local aid calculations and general line item programs. All of these factors combined means that the budget bill is a very complex and meticulously planned piece of legislation.

Governor Healey’s budget proposal for this upcoming fiscal year sees major increases in state funding across a variety of different areas of public need. Overall, this budget has a $7.4 billion increase compared to the 2023 Fiscal Year budget, as proposed by former Governor Baker. With this large increase in funding, many programs financed by the state will see expansions in funds allotted.

Alongside budget bill HB57, budget briefs regarding local aid and tax relief were released. The briefing for local aid outlined the funding available for local needs including school systems, regional governments, libraries, veteran services, and more. Nearly $8.4 billion in local aid is provided according to this budget, a $635 million increase from the previous year. This allocated money includes almost $7 billion in education funding, of which the majority ($6.5 billion) is part of Ch.70 funding , which is the state aid to public school districts throughout Massachusetts. The rest of the education budget is reserved for school transportation, charter school reimbursement, the special education circuit breaker, and increased rural school aid. The remaining $1.5 billion in local aid is destined for general government aid. This includes funding for public libraries, public safety, veteran’s benefits, and general municipal government aid.

The budget brief for tax relief was also released, outlining the proposed tax structure for the Commonwealth. Governor Healey has proposed a tax relief package that will cost the Commonwealth $742 million. Some key highlights of the tax changes include a $600 tax credit per dependent, available at all income levels. Estate taxes have also been lowered, with no tax on estates worth less than $3 million. Current Massachusetts law has an estate tax beginning at 0.8% of estates over $1 million, with 70% of estates currently paying taxes on it. This revision would eliminate nearly all estate tax. The cap for rental tax deductions is also proposed to increase from $3,000 to $4,000 in an effort to aid the housing problem pervasive in Massachusetts.

Additionally, the cap on the senior circuit breaker credit would be doubled to approximately $2,400. The tax rate on short-term capital would jump up from the current 5% to 12%. In addition, other tax-related changes include credit for apprenticeship programs, increased commuter transit benefits for regional transit and biking, income tax exemptions for student loan repayment, and an extension of the Brownfields program which aims to clean contaminated land. On top of that, there would be increased credit for lead paint removal and septic tank replacement and one for dairy farmers. These tax changes all aim to make the tax structure more competitive, equitable, and affordable, according to Governor Healey.

As mentioned previously, this year’s budget sees major increases in state funding to a variety of different programs. Some of this growth in funding comes from an estimated extra $1 billion in revenue that will come from the newly approved Fair Share Amendment. This amendment to the state constitution establishes a 4% tax on annual income above $1 million. This is in addition to the current 5% flat income tax rate here in Massachusetts. The additional money raised from this tax has been designated to be spent on high-quality education funding and a transportation fund devoted to repairing roads and improving public transportation overall. With an extra $1 billion in funding, it is no surprise that the budget increased so dramatically for the 2024 fiscal year.

Some of the most noteworthy increases in fund allocations involve education, too. Part of the Governor’s budget calls for an almost 25% increase in spending on colleges and universities. This increase would help go towards locking the tuition prices of Massachusetts state universities for the next four years. Along with this tuition lock, the budget allows funding for more financial aid for students. The budget also establishes MassReconnect, which is a $20 million plan to fully fund an associates degree for those 25 years and older.

As well as funding for higher education, this plan also directs $1.455 billion towards early education and childcare. Of this, $475 million goes to supporting the continuation of grants through the funding of Commonwealth Cares for Children. These grants work to help stabilize the early education and care system in the Commonwealth by providing funding for an increase in staff compensation as well as prevent the closing of beleaguered child care centers.

Another critical aspect of Governor Healey’s budget is the funds that are directed towards transportation, with the Department of Transportation receiving $1.3 billion in funding. As mentioned prior, a lot of funding for transportation will be drawn from the money received from the newly-enacted Fair Share Amendment. These funds are meant to improve highway infrastructure as well as invest in the East-West rail. Of this $1.3 billion, $529 million is funding the Department of Transportation directly, while $100 million is going to local transportation projects. Another $187 million is going towards funding the MBTA. All funding mentioned above, is in addition to the money that the Department of Transportation will receive from the Fair Share tax.

Additionally, housing in Massachusetts has been a significant concern, with prices skyrocketing. In order to address this, $353 million in the budget has gone towards housing and food assistance programs, in addition to parts of the tax relief aimed at bettering housing costs. $45 million of this will go towards an expansion of the Department of Housing and Community Development’s (DCHD) Emergency Assistance Family Shelters and Services Program. A further $41 million will go towards aid for students whose families are experiencing homelessness, along with $65 million to continue the universal free student meals pilot program. The Supplemental Nutrition Assistance Program (SNAP), which was increased during the pandemic, will see a budget of $130 million to cover a three-month ramp-down of SNAP as well as $2 million to reimburse those whose SNAP payments were stolen.

MassHealth is also a very important area Healey’s budget addresses. The largest single program in the budget, MassHealth is set to receive $19.8 billion in funding. Much of this is considered an investment by the Healey administration to improve access to care for all Commonwealth residents. This funding is going to a variety of different areas, with one of the most noteworthy being the increase in access to MassHealth for Massachusetts residents. The additional funding for this is necessary as the administration’s current plan is to end the asset test for the Medicare Savings Program, which is expected to increase the number of residents who have access to MassHealth. Along with the preparations for this increase in access, there is also $80 million designated for behavioral health providers to help address the current workforce shortages.

In addition to the focus on housing, healthcare, and education, funding towards economic development is also heavily emphasized in this budget. The budget proposes $400 million for MassWorks grants to further local infrastructure projects as well as $585 million in bond authorizations for a variety of other economic development projects.

Governor Healey’s budget sees large increases in funding towards social programs and community development initiatives in comparison to former Governor Baker’s 2023 fiscal year budget. The Executive Office of Education sees a $2 billion increase in state funding in the 2024 fiscal year in comparison to the current fiscal year. Similarly, the Department of Transportation will be receiving $600 million in increased funds as well. Overall, Governor Healey’s budget bill allocates a much larger amount of funding to various state programs than the budgets produced by the previous administrations.

The budget bill currently sits in the House, which is set to release its own version in April, and then continue on to the Senate. The budget can be expected to be finalized in July 2024. Between now and then, it is subject to much debate and amendments, as the legislature decides how to allocate funds. Staying on top of such an important bill may seem overwhelming, but with comprehensible section-by-section budget summaries, daily bill action alerts, and amendment summaries, InstaTrac makes it easy! Never miss a blog post - and stay on top of what’s happening on Beacon Hill! Follow us on Twitter, Linkedin,Youtube, or Instagram.