Complete Guide to the Massachusetts State Budget Process

The Massachusetts budget process is an annual cycle involving the Governor, the Legislature, and numerous state agencies. The process typically spans from early fall through the beginning of the new fiscal year on July 1st, and involves multiple stages of development, review, negotiation, and approval.

Key Budget Documents

General Appropriations Act (GAA): The primary annual budget bill that funds most state operations and programs.

Supplemental Budgets: Additional appropriations bills passed during the fiscal year to address unforeseen needs or adjust funding levels.

Capital Budgets: Additional appropriations bills passed during the fiscal year to address

Outside Sections: Policy provisions included in budget legislation that change existing law, often controversial as they bypass the normal legislative process.

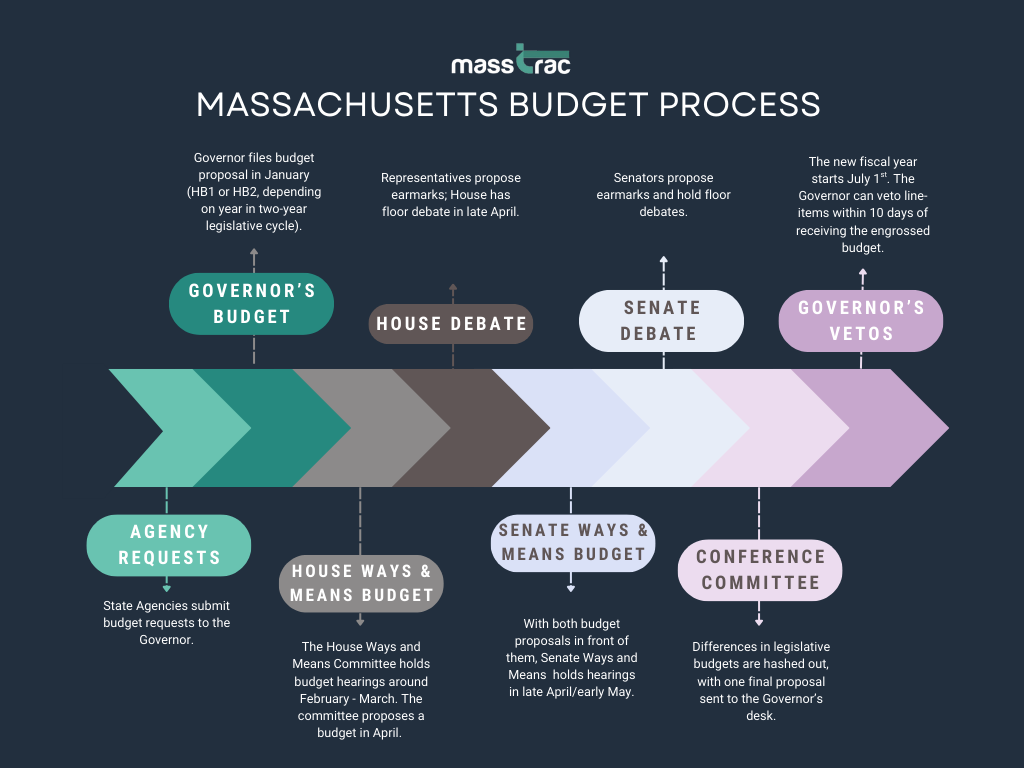

The Budget Cycle

Phase 1: Agency Requests (September - October)

The budget process begins more than nine months before the start of the fiscal year. In early fall:

The Executive Office for Administration and Finance (A&F) issues budget instructions to all state agencies.

Each agency prepares and submits detailed budget requests for the upcoming fiscal year.

Agencies justify their funding needs based on program requirements, caseload projections, and policy priorities.

A&F analysts review agency requests and hold hearings with agency officials.

Phase 2: Governor’s Budget Proposal (January)

By the fourth Wednesday in January (per state law), the Governor must submit a proposed budget to the Legislature:

The Governor’s budget reflects administration priorities and policy initiatives.

The proposal includes detailed line-item appropriations for every state agency and program.

Revenue projections from the Department of Revenue inform spending levels.

A budget message explains the Governor’s fiscal strategy and key investments.

Supporting documents provide detailed justifications for each appropriation.

The Governor’s budget is filed as House Bill 1 or House Bill 2 depending on the year of the two-year legislative cycle. It serves as the starting point for legislative deliberations.

Phase 3: House Budget Development (February - April)

The House Ways and Means Committee takes the lead on developing the House budget.

Committee Review (February - March)

The House Ways and Means Committee holds hearings on the Governor’s proposal.

All state secretaries and agency heads testify before the committee.

Committee staff analyzes agency budgets, revenue projections, and policy proposals.

Other House committees may hold subject-area hearings on budget priorities.

House Budget Release (Mid-April)

The House Ways and Means Committee releases its budget proposal.

This version often differs significantly from the Governor’s proposal.

The committee holds a brief public hearing on its proposal.

House Floor Debate (Late April)

The full House of Representatives debates the budget over several days.

Representatives can file earmark amendments requesting funding for specific projects in their districts, typically small-dollar items (ranging from $10,000 to $250,000) that are added to specific line-items.

The House Ways and Means Committee reviews all amendments, organizes them by subject matter, and submits them in the form of a consolidated amendment. This doesn’t guarantee the exact language of an amendment is included. The consolidated amendments are then voted on in batches on the floor.

After debate concludes, the House votes on the final budget package.

The approved House budget is sent to the Senate.

Phase 4: Senate Budget Development (May)

The Senate Ways and Means Committee develops its version of the budget.

Committee Review (Late April - Early May)

The Senate Ways and Means Committee reviews both the Governor’s and House budgets.

The committee holds hearings with administration officials.

Committee staff conduct independent analysis.

Senate Budget Release (Mid-May)

The Senate Ways and Means Committee releases its budget proposal.

This version reflects Senate priorities and often differs from both the Governor’s and House budgets.

The committee holds a public hearing on its proposal.

Senate Floor Debate (Late May)

The full Senate debates the budget over several days.

Senators file earmark amendments to modify the committee’s proposal.

The Senate Ways and Means Committee consolidates amendments, not always by subject matter, brings them to the floor, and the chamber votes on the final budget package.

The approved Senate budget moves to the conference committee stage.

Phase 5: Conference Committee (Late May - June)

Since the House and Senate versions differ, a conference committee reconciles the two.

Committee Composition

Three representatives appointed by the House Speaker.

Three senators appointed by the Senate President.

One member from each chamber must be from the minority party, ensuring bipartisan participation.

The committee generally operates behind closed doors without public hearings, but have been holding some public hearings in recent years.

Negotiation Process

Committee members negotiate differences between House and Senate versions.

Discussions cover spending levels, outside sections, and policy provisions.

The Governor’s administration may participate informally in negotiations.

The committee works to reach consensus on a unified budget.

Conference Report

The committee produces a conference report reconciling all differences.

Phase 6: Final Legislative Action (Late June)

The conference committee should complete its work just before the July 1st deadline, though it’s notoriously been late and usually is publicized in August.

The conference report is released publicly.

The House and Senate debate and vote on the conference report.

Both chambers must approve the identical budget for it to advance.

If approved, the budget is sent to the Governor’s desk for signature.

Phase 7: Governor’s Action (Late June - Early July, usually pushed back though)

The Governor has several options when the budget reaches their desk:

Sign the Budget

The Governor can sign the entire budget into law.

Line-Item Veto

The Governor can veto specific appropriations or outside sections.

Vetoed items are returned to the Legislature.

Return with Recommendations

The Governor can return the budget with recommended changes.

This is less common than the line-item veto.

Allow to Become Law Without Signature

If the Governor takes no action within 10 days, the budget becomes law automatically. This almost never happens, generally because the Governor wants to weigh in with vetos and recommendations.

Phase 8: Veto Override (July)

If the Governor vetoes appropriations or sections, the Legislature can respond.

The House and Senate can vote to override vetoes.

A two-thirds vote in each chamber is required to override.

Override sessions typically occur in late August, but can go as far as into the fall.

Sustained vetoes remain in effect; overridden vetoes are restored to the budget.

The final enacted budget becomes law and governs state spending for the fiscal year from July 1 to June 30.

Major Spending Categories

MassHealth (Medicaid) - Typically the largest single expenditure, providing health coverage for low-income residents.

Education - Including local aid to cities and towns, Chapter 70 education funding (a formula to fund K12 schools), and higher education.

Debt Service - Interest and principal payments on state bonds.

Other Post-Employment Benefits (OPEB) - Health care and pension obligations for retired state employees.

Human Services - Including mental health services, developmental disabilities services, child welfare, and transitional assistance (different from MassHealth).

Public Safety - Corrections, state police, courts, and district attorneys.

Transportation - MassDOT operations and projects.

Environmental Affairs - Parks, environmental protection, and conservation.

Economic Development - Business development programs and workforce training.

General Government - Administrative functions, constitutional officers, and the legislature.

Important Budget Concepts

Consensus Revenue Hearing

Before budget negotiations conclude, the Governor and legislative leaders typically agree on a consensus revenue estimate. This agreed-upon projection of tax collections establishes the total amount available for appropriation and helps prevent budget shortfalls.

Fair Share Surtax

In November 2022, Massachusetts voters approved a 4% surtax on annual income above $1 million, known as the Fair Share Surtax, which took effect on January 1, 2023. The constitutional amendment dedicates all revenue from this surtax exclusively to education and transportation purposes.

Key Features:

The revenue comes from an additional tax on households with very high annual income, with the $1 million threshold adjusted annually for inflation.

Revenue is constitutionally dedicated and cannot be used for other purposes or subject to revenue cap calculations.

All appropriations funded by Fair Share are designated in a separate budget section (Section 2F) and identified as either recurring or one-time spending.

Stabilization Fund (Rainy Day Fund)

Massachusetts maintains a stabilization fund to save surplus revenues and provide a cushion during economic downturns. The fund’s balance and any deposits or withdrawals are important budget considerations.

Local Aid

A significant portion of the state budget is distributed to cities and towns through various local aid accounts, most notably Chapter 70 education funding and Unrestricted General Government Aid (UGGA).

Designated Funds

Some revenue sources are legally dedicated to specific purposes and don’t flow through the general appropriations process. Examples include gasoline taxes for transportation purposes and lottery revenues for local aid. Following in this vein, the Fair Share Surtax is just to fund transportation and education. This is not to be confused with earmarked amendments legislators propose during negotiations.

Supplemental Budgets

During the year, the Legislature often passes supplemental budget bills to provide additional appropriations, adjust spending levels, or address deficiencies.

Outside Sections

Budget bills frequently include “outside sections” that change existing state law. These policy provisions are usually controversial because they can enact significant legal changes and sidestep the normal legislative committee process.

Glossary of Budget Terms

Appropriation: Legal authorization to spend a specific amount for a specific purpose.

Bond Bill: Legislation authorizing borrowing for capital projects, generally infrastructure. These are funded through the issuance of bonds.

Chapter 70: Primary state aid for K-12 education distributed to cities and towns.

Conference Committee: Six-member committee that reconciles House and Senate budget differences.

Deficiency Budget: Supplemental appropriation to cover shortfalls in current fiscal year budget for programs that have already been funded. .

Earmark: Funding designated for a specific project or purpose.

Line-Item: Individual appropriation account in the budget.

Outside Section: Policy provision in budget bill that changes existing law.

Rainy Day Fund: Common term for the stabilization fund.

Retained Revenue: Authority for agencies to spend fee revenue they collect.

Supplemental Budget: Additional appropriations during the fiscal year

UGGA: Unrestricted General Government Aid to municipalities.

How MassTrac Helps Navigate the Budget Process

As policy-making increasingly shifts to the amendment process, staying informed becomes more challenging. In recent years, House budget amendments have exceeded 1,600 amendments—each essentially functioning as a mini-bill rushed through with little advance notice, no public hearing, and limited time to organize or strategize.

MassTrac Tools:

Plain English Summaries: All outside sections and budget amendments are rewritten in clear, accessible language so you can quickly understand what’s actually being proposed without decoding legislative text.

Real-Time Amendment Tracking: Track amendments just as you would track bills, with notifications when they’re filed, modified, or acted upon.

Transparency Through the Backroom Process: Because House budget decision-making on amendments lacks transparency, MassTrac unbundles consolidated amendments in real time, showing you:

Whether your amendment made it out of committee intact

How it was changed during negotiations

If it didn’t make the final version or was withdrawn

Refiled Amendments: Special indicators show when an amendment has appeared before or when a current bill has been slipped into the budget as an amendment, helping you understand the broader legislative strategy.

MassTrac Authored Reports: See special budget reports like line-item comparison reports that track budget proposals across the Governor’s, House, Senate, and Final budgets. We also publish an earmark by legislator report exactly what each legislator requested versus what they actually secured.

Transcripts: See the video of floor debates along with a clickable, searchable transcript.

By understanding the budget cycle, key participants, and opportunities for input—and by using tools like MassTrac—lobbyists, lawyers, and advocates can more effectively engage in this democratic process.